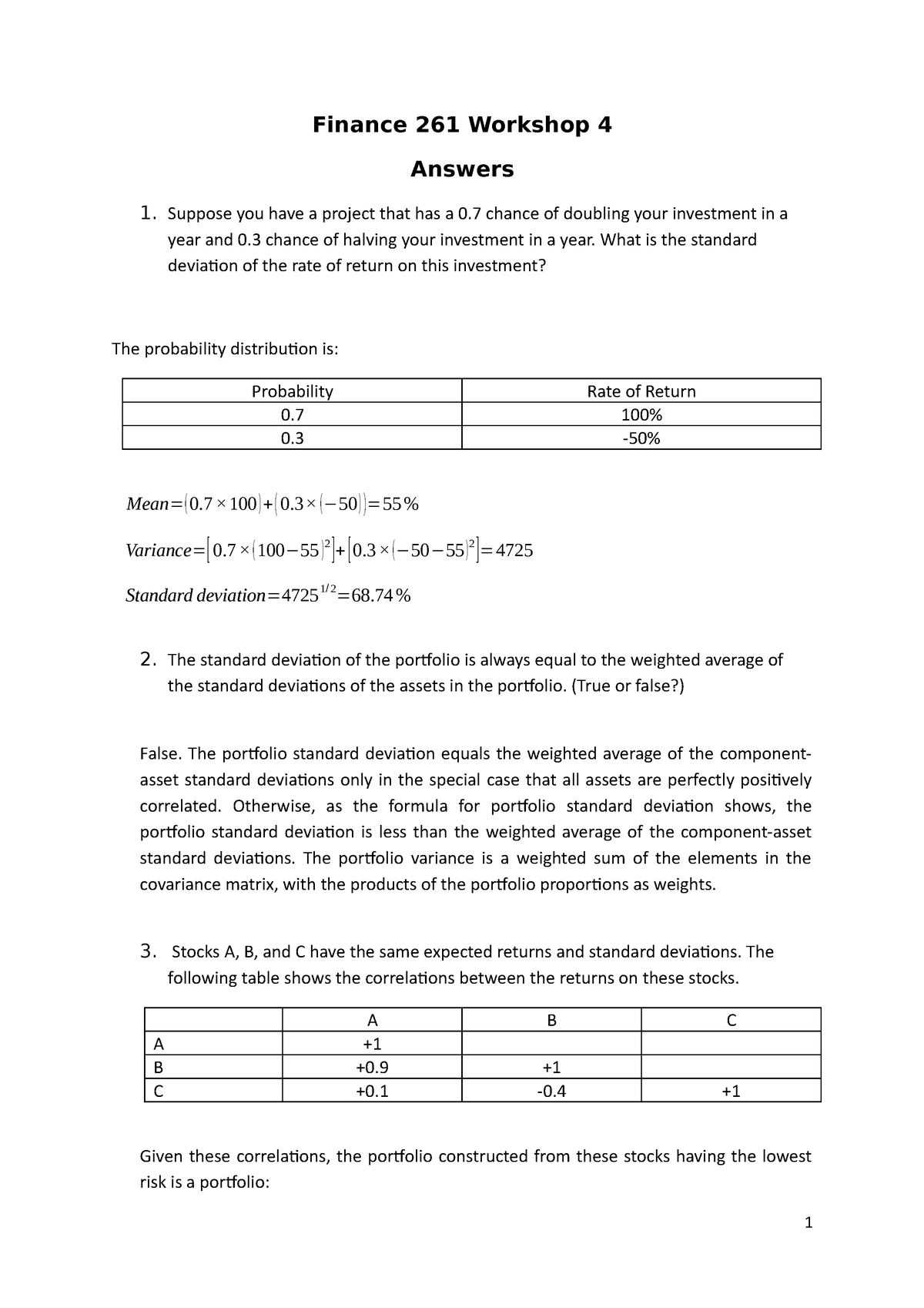

Consider the following information: State of Probability of State Rate of Return if State Occurs Economy... - HomeworkLib

Why Does an Equal-Weighted Portfolio Outperform Value- and Price-Weighted Portfolios? | EDHEC Risk Institute

The Properties of Equally Weighted Risk Contribution Portfolios | The Journal of Portfolio Management

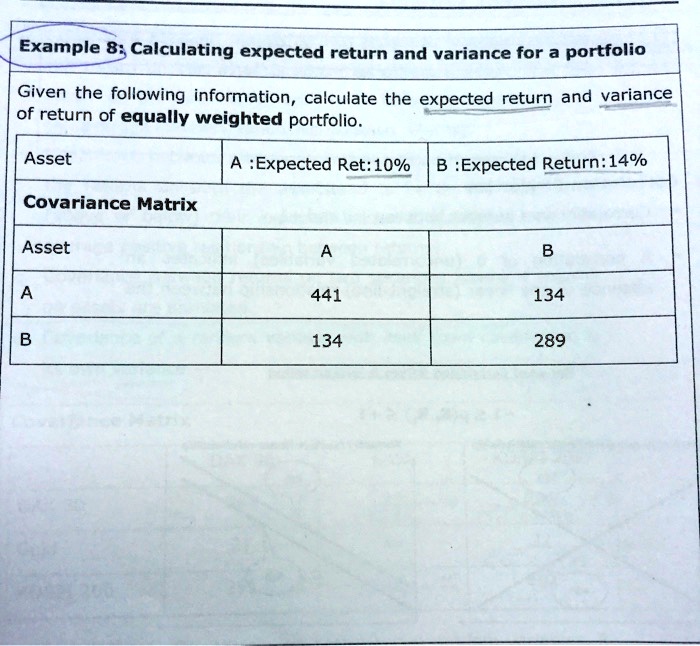

Combining the minimum-variance and equally-weighted portfolios: Can portfolio performance be improved? - ScienceDirect

:max_bytes(150000):strip_icc()/dotdash_Final_Equal_Weight_Apr_2020-01-6b2bdb8ccaf74b8d9170fafe5851d5df.jpg)

/dotdash_Final_Equal_Weight_Apr_2020-01-6b2bdb8ccaf74b8d9170fafe5851d5df.jpg)