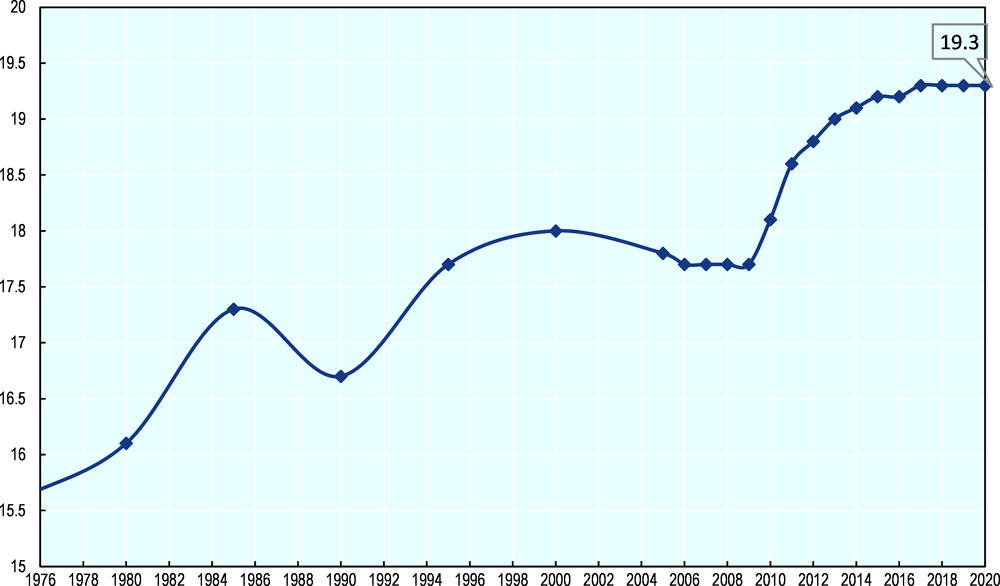

2. Value-added taxes - Main features and implementation issues | Consumption Tax Trends 2020 : VAT/GST and Excise Rates, Trends and Policy Issues | OECD iLibrary

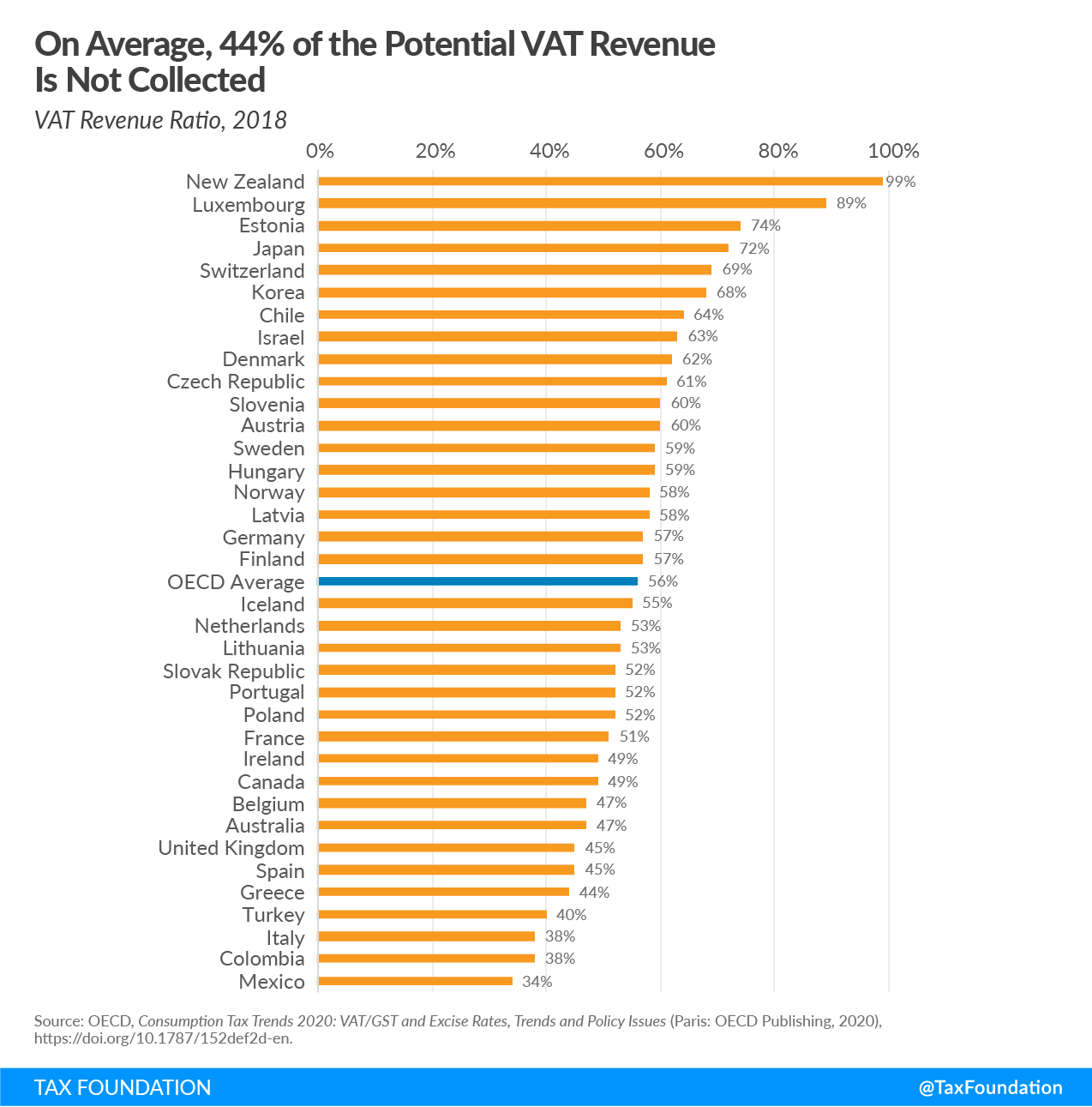

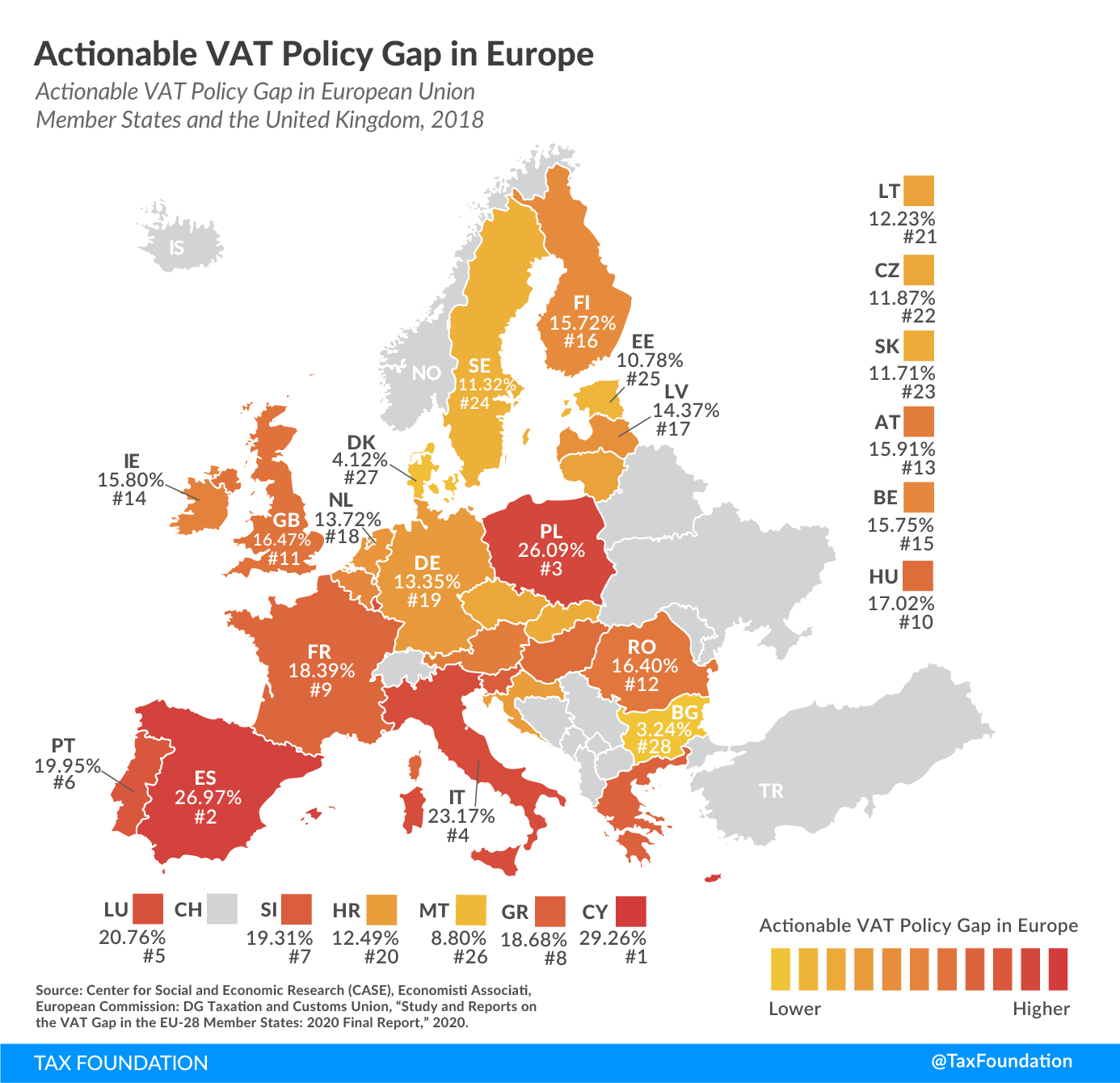

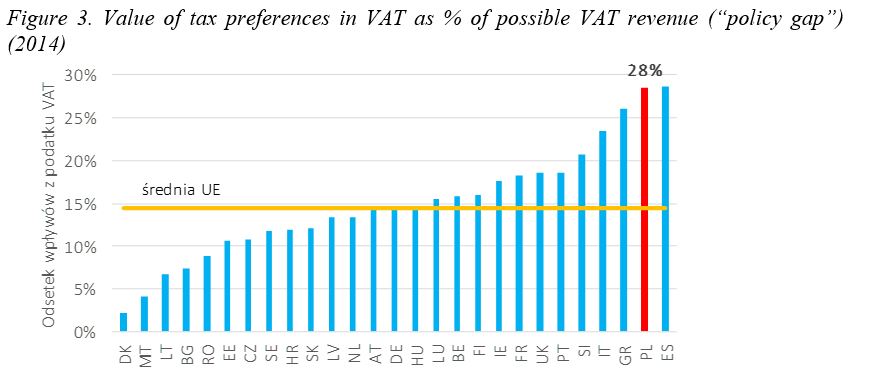

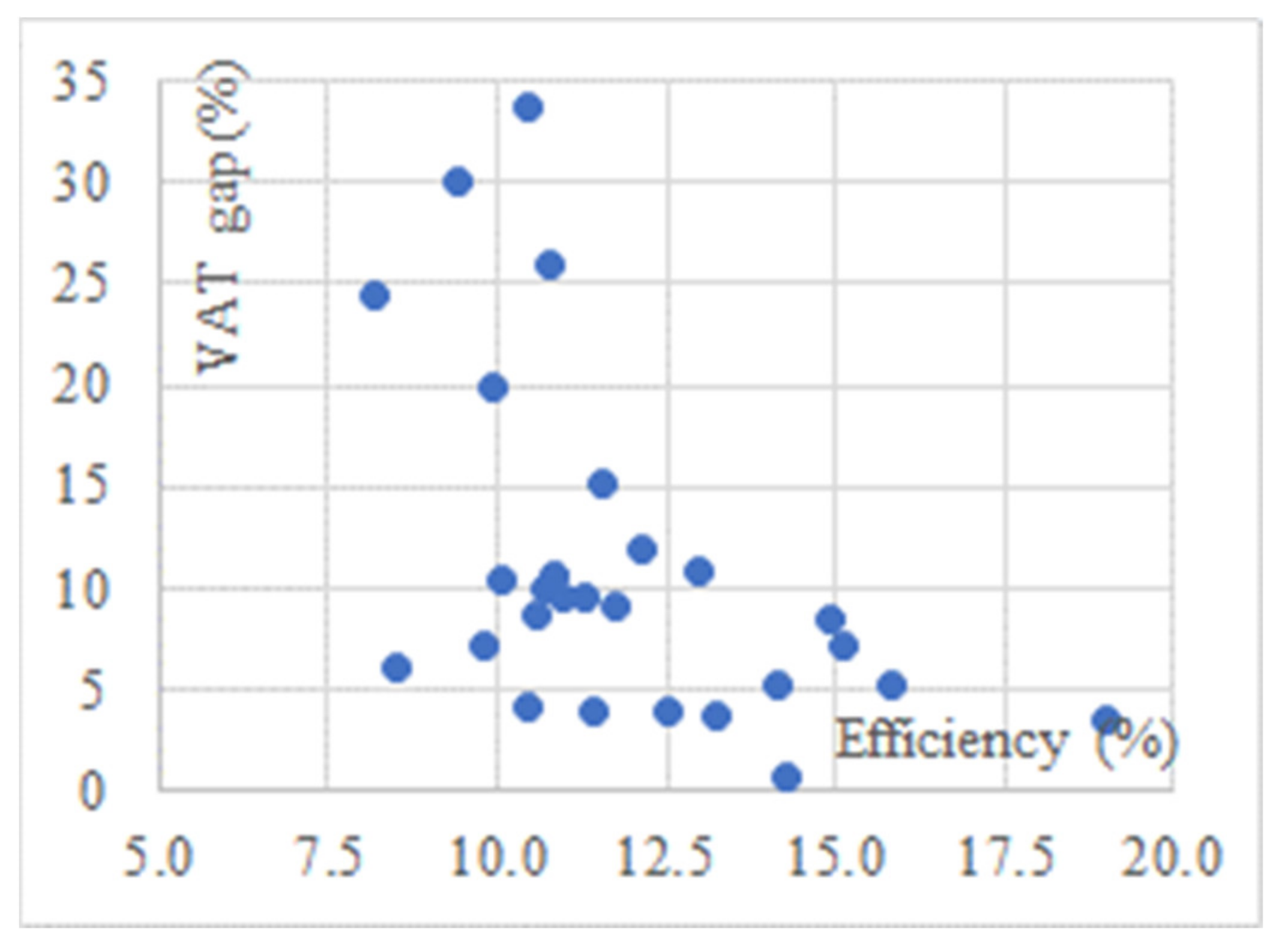

Sustainability | Free Full-Text | VAT Efficiency—A Discussion on the VAT System in the European Union | HTML

2.3. VAT Gaps in 2000-2003 against the values in 2008-2011, 26 countries | Download Scientific Diagram

2. Value-added taxes - Main features and implementation issues | Consumption Tax Trends 2020 : VAT/GST and Excise Rates, Trends and Policy Issues | OECD iLibrary